Shop Your Policy MI

Two of Michigan’s largest advocates for auto accident survivors and their care providers, CPAN and MBIPC, have put together a website to help Michiganders understand the potential pitfalls of selecting low PIP coverage after the auto reform.

Website:

Why choose unlimited PIP coverage?

Under the new law, there are six levels of coverage, each slightly cheaper but with much greater risks compared to Unlimited/Lifetime coverage. Survivors of catastrophic accidents can face initial (acute) medical bills of up to half a million – for example, if a spinal cord injury or traumatic brain injury is sustained, a 2-4 week hospitalization plus several surgeries would rack up a bill quickly. However the care after leaving the hospital (post-acute care) can impact a survivor’s quality of life for the rest of their lives, with costs such as 24/7 attendant care ($4000 – $12000 per week!), work loss for two years, ongoing therapies, lifetime medical supplies, lifetime mobility equipment, etc. It is not uncommon for a person to reach $10M in expenses in the first decade after a catastrophic injury in a car accident. So how can a $50,000 or even $500,000 cap in coverage save anyone money?

“From a broken arm or leg to a spinal cord injury or brain injury, the costs of emergency room visits, surgeries, post-acute care and long-term rehabilitation can take a financial toll on you and your family. The cost of severe or catastrophic injuries can be thousands to millions of dollars – PIP coverage protects you.”

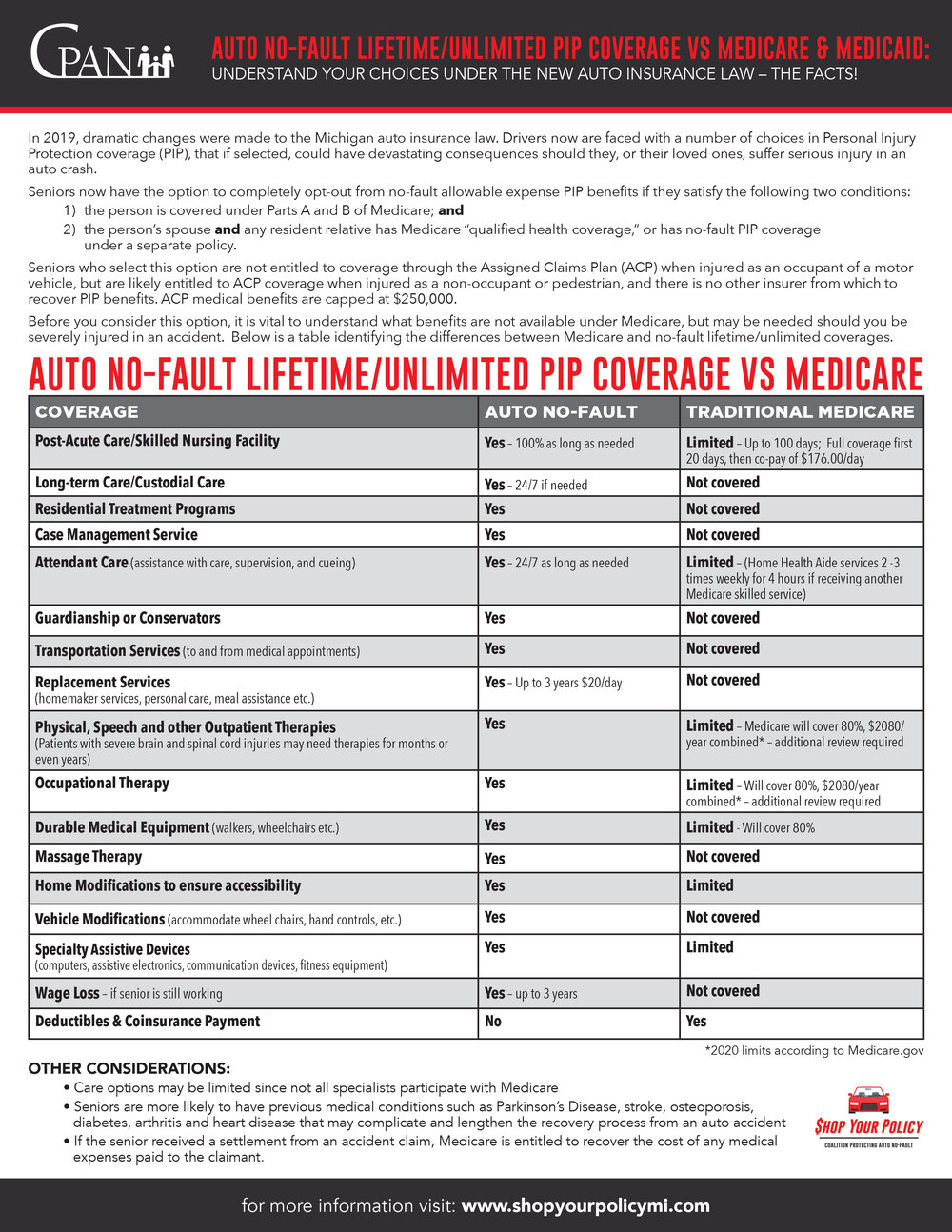

What happens if you choose less coverage because you have Medicare?

“Under the new law, seniors have the option to completely opt-out from no-fault allowable expense PIP benefits if they satisfy the following two conditions: 1.) The person is covered under Parts A and B of Medicare; and 2.) The person’s spouse and any resident relative has Medicare “qualified health coverage” or has no-fault PIP coverage under a separate policy.

Before you consider this option, it is vital to understand what coverage is not available under Medicare but may be needed should you be severely injured in an accident.”

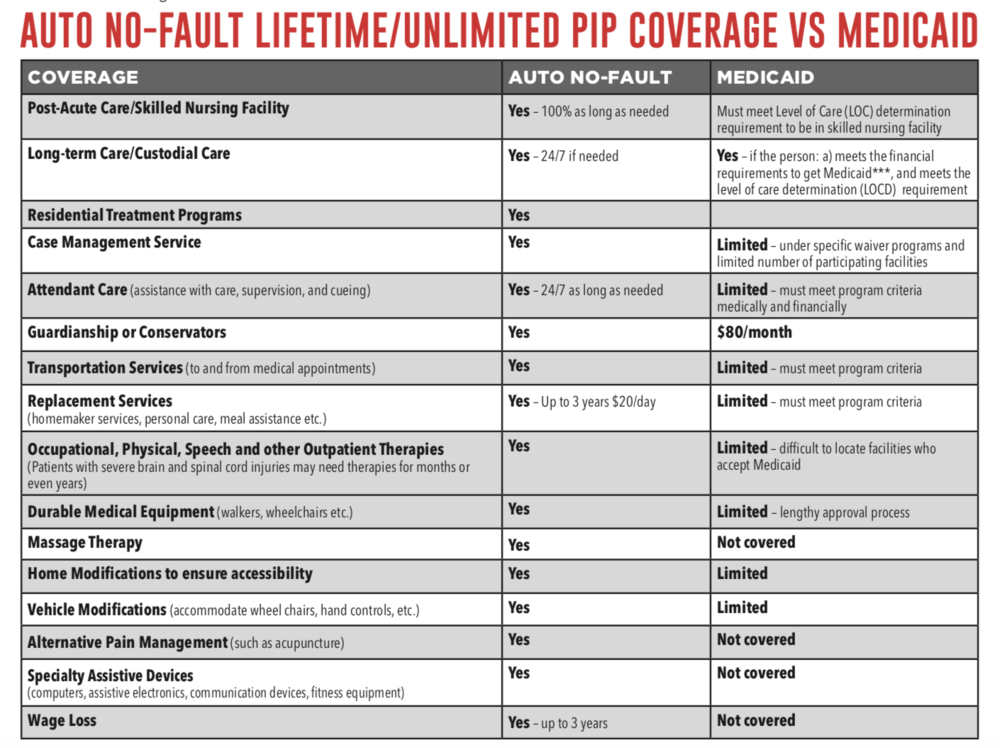

What happens if you choose less coverage because you have Medicaid?

“Under Michigan’s new auto insurance law, one option for Personal Injury Protection (PIP) coverage is to purchase a $50,000 policy if you meet the following criteria:

the named insured is enrolled in Medicaid, and

any spouse and resident-relatives of the named insured are also covered under Medicaid or under a qualified health insurance plan with a less than $6,000 deductible or have PIP coverage under a separate auto insurance policy.

If you select this option, your auto insurance company will pay up to $50,000 per person, per accident. This limited/capped coverage would not be enough to cover your medical costs or provide access to care if you or your loved ones were seriously injured and reliant on the Medicaid system.”

Videos

You can see more videos on How to Shop Your Policy MI at: https://shopyourpolicymi.com/videos

Unless noted, this company or website has not been verified by, is not affiliated with, and is not endorsed by the Michigan Interfaith Coalition. This resource is provided for informational purposes only.